Decentralized finance (DeFi) – Explanation, Advantages and Risks

DeFi is a new frontier in finance that allows users to take control of their own finances, without the need for middlemen and with reduced transaction costs.

DeFi encompasses three main categories: Tokenized securities, stablecoins, and market-making.

Tokenized securities include tokens that represent equity or debt issued by a company or state, whose value is determined by its market cap on multiple cryptocurrency exchanges. Stablecoins are cryptocurrencies pegged to more traditional institutions such as the USD, GBP or EUR. Market-making refers to companies that provide over-the-counter (OTC) derivative products such as futures, forwards, options, and contracts for difference (CFDs).

DeFi Crypto – The Future of Finance?

DeFi can be defined as digital finance that allows users to cut out traditional financial intermediaries and use their services directly on a peer-to-peer basis. It allows individuals to borrow money or become lenders without having to go through a bank or financial institution. Therefore, it is sometimes referred to as decentralized banking.

Contents

- 1 What is Decentralized finance?

- 2 Popular DeFi projects

- 3 Is DeFi better than traditional banking?

- 4 What are the advantages of DeFi?

- 5 What are the disadvantages and risks of DeFi?

- 6 Still a Solid Investment

- 7 Do decentralized currencies need DeFi?

- 8 How will Decentralized finance change the world in the future?

- 9 What other risks are there?

- 10 What countries are in the lead when it comes to DeFi?

- 11 What are the next steps for DeFi?

- 12 Defi staking vs crypto loans: Which use cases do they most benefit?

- 13 Crypto Maniac Defi: How to make money in DeFi?

- 14 The first DeFi application

- 15 Ethereum and Decentralized finance (DeFi)

- 16 Conclusion – Is DeFi the future of finance?

- 17 References:

What is Decentralized finance?

DeFi (Decentralized Finance) is a new frontier in finance that allows users to take control of their own finances, without the need for middlemen and with reduced transaction costs. With DeFi, users can gain access to financial services and experience benefits such as:

- Trustless transactions

- No intermediaries

- Greater access to funding

- Easier access to lending

- Lower fees due to less middlemen

- Lower risk due to. . .a lack of intermediaries

Decentralized finance is a new form of finance in which users can take control of their own finances without the need for middlemen.

The future of finance is very clear. It will be decentralized and built on blockchain technology. In order to achieve this future, platforms such as Everex are bringing blockchain technology into the traditional financial services market. Decentralized finance is one of the most important trends in finance, and it will help transform the way that we transact and allocate funds.

With DeFi, transactions can be anonymous and free of any fees. The reason for this is that middlemen are not necessary for transactions to occur. This is a significant change from how most transactions are currently carried out. In the current financial system, banks and financial intermediaries provide benefits such as trust and security. However, these institutions also charge transaction fees for this service. With DeFi, users can maintain anonymity while still receiving trust and security.

The main benefit of decentralization in finance is that users are no longer at the mercy of large institutions like banks when it comes to their finances. Users can access funding or finance without having to earn the approval of financial intermediaries first.

Popular DeFi projects

DeFi Crypto – popular projects

By far the most popular project which can be used for DeFi is Ethereum.

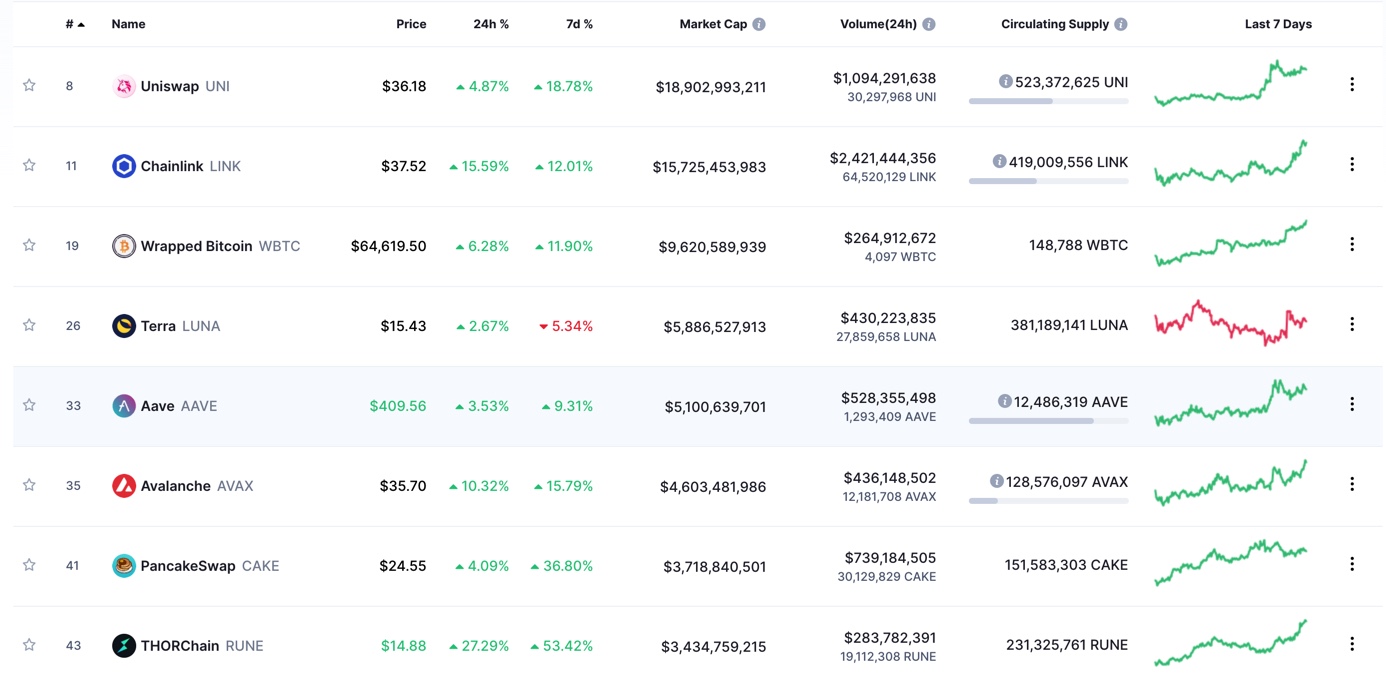

Some other popular DeFi projects with a high market cap are:

- Uniswap

- Chainlink

- Wrapped Bitcoin

- Terra

- Aave

- Avalanche

- PancakeSwap

- THORChain

Is DeFi better than traditional banking?

The idea of traditional banking is that users can have a relationship with financial institutions that are trusted and familiar. However, as banks consolidate and grow larger, certain users miss out on their services because they are not seen as profitable enough by these banks to be banked. For example, users who wish to make international transactions may find that it takes a long time for them to be able to access international banking services. Users who wish to borrow money may be turned down if they have too many credit inquiries or negative credit history in their past.

With DeFi, users are no longer at the mercy of financial intermediaries at all. Users can access funding, choose a lender, and make transactions on their own terms.

DeFi is also a more ethical form of finance because it does not require users to provide personal information to banks or large financial institutions in order to receive these services. This means that users can take control over their data and use this data as they see fit.

Decentralized financial platforms are also not-for-profit. While a user may be disappointed that they cannot access traditional banking in some cases, payments in DeFi finance are always free of charge. In a decentralized system, giving investors a return is not the main goal. Instead, the purpose of DeFi is to allow anyone to take control over their own finances and make transactions without it costing anything at all.

The DeFi landscape is changing rapidly, with new projects and innovations being launched every day. There are currently thousands of different protocols and platforms that act as decentralized financial services. Current products in the market include tokenized securities, stablecoins, and market-makers.

Tokenized securities refer to any type of asset backed by a blockchain. These assets can be anything from stocks to bonds or even smart contract-based assets such as real estate or artworks.

What are the advantages of DeFi?

There are a number of advantages to DeFi and its decentralized nature. Firstly, users can take control of their finances without the need for financial intermediaries. This does not mean that financial intermediaries are bad or ethically questionable. Rather, it means that people do not need to rely on them in order to get access to their finances. Users can be truly independent of traditional banks when it comes to transactions as they have the ability to set up their own accounts on financial platforms.

With DeFi, users no longer need to pay up-front fees in order to receive any services. The money that a person invests is returned directly to them, with no markup or percentages imposed. This decentralization of finance also makes it easier for users to take their finances with them when they move from one part of the world to another. It is not necessary for them to find a financial institution in a new country and begin paying fees, because they will have all their funds on their own terms in DeFi systems.

Another advantage to DeFi is that users can now take full control of their finances without the fear of losing money. With centralized financial services, there is always the risk of identity theft. This happens more often with larger companies such as banks because they need to collect customers’ personal information in order to have effective data analytics. Personal information can be hijacked and used by others meant to scam or steal from users. For example, it is not uncommon for large banks to lose millions of dollars in customer funds due to faulty technology or hacks. With a decentralized system, users do not need to give anyone their information in order to access banking. They can set up their own accounts and use DeFi platforms anonymously.

What are the disadvantages and risks of DeFi?

DeFi can come with some drawbacks as well. Firstly, being decentralized means that there is less regulation than centralized systems such as banks. Therefore, it is easier for fraud and theft to occur in these environments. One example of this would be a user who is hacked because of a poor security system. The money they have invested is then taken from them and their identities may be stolen as well.

The decentralized nature of DeFi makes it more difficult for users to withdraw funds from the platform. Unlike banks, these platforms do not typically offer debit cards or easy access to bank transfers. It can take days or even weeks for users to get their money out – and certain protocols might not even allow them to do so.

The decentralized nature of DeFi also makes it more difficult to regulate. In order to have a centralized institution such as the Federal Reserve, the government must pass laws that are approved by the people. This allows for transparency and accountability on exactly how funds are used. Instead of the majority of funds being in a black box, they are held on an open ledger that is easily accessible to anyone who wants to check it out.

Lastly, DeFi is not without its problems. As mentioned above, there are some issues with getting funds out of these platforms. The more time that passes between the time a user puts money into a platform and the time they want to get it out, the less likely they are to receive their funds in full. This is due to the large amount of fees that banks charge, which in turn means less profit for DeFi platforms.

Still a Solid Investment

Despite some of its faults, DeFi is a solid investment. Since it allows users to use cryptocurrency as they please, the same properties that make it so popular as an investment are also what makes DeFi a popular choice for traders. For instance, if you’re looking for profits in the short term, trading DeFi is going to be your best bet. In addition, if you’re looking for the most opportunity to grow your assets, DeFi is an excellent choice.

There are many reasons why DeFi could play a bigger role in the future of cryptocurrency and trading. It has all of the features that many traders want and some really exciting new ones. As it continues to expand, DeFi will continue to bring more value to the ecosystem as a whole.

Do decentralized currencies need DeFi?

No, they don’t. If you want to use a local currency that only people near you use, then no DeFi is needed. At the same time, if you want to have some complex financial transactions that are more efficient than having your own bank account, then DeFi is great for that too. What it really does is make a lot of potential financial instruments available to everyone. What are the similarities between DeFi and mainstream systems?

The main similarity between Decentralized Finance (DeFi) and its traditional banking counterparts is how they deliver financial services. These decentralized financial services allow users to access funding or even become lenders without having to go through a bank or financial institution first. For example, you could use DeFi to trade cryptocurrency and receive a loan at the same time.

Another similarity between DeFi and traditional financial services is that there are less middlemen involved in the transaction. Instead of needing to use a middleman like a bank, credit card company, or even PayPal, users can now apply for financing directly on their own terms without any additional charges imposed by these intermediaries.

How will Decentralized finance change the world in the future?

Decentralized finance brings a lot of great benefits to the traditional financial system. As mentioned above, it makes credit and personal information much less valuable and harder to steal. Being able to use a decentralized system means that users are not beholden to any one institution or government in order to receive their services.

One of the most important driver’s of innovation is participation by the people. As DeFi grows, so will its potential for positive change. DeFi makes our financial lives more efficient and better as a result of its ability to connect people with the services they need at a greatly reduced cost.

What other risks are there?

The main risk to Decentralized Finance is that the system cannot be regulated. Because of this, it also means that it is more vulnerable to fraud and fraudulent activity. Because DeFi does not require any information from users in order to access their finances, there is no way of tracking these transactions or identity theft. Users should consider the potential for fraud with DeFi before deciding whether or not they would like to give it a try.

DeFi also has some issues with volatility at the current time as well. Since cryptocurrency as a whole is so volatile in value, it can be difficult for a person to determine if an investment will pay off in the short term or not.

Will there be a decentralized company that functions like Amazon? No and no. Decentralized companies do not need to function like Amazon or any other centralized company in the future. It is a great benefit to have companies that provide traditional services online that are decentralized and offer the same benefits like Amazon and eBay. However, a decentralized company will never be able to cost-effectively operate like a traditional organization does because of the amount of manual processes involved with operation, efficiency, and data security at the current time.

What countries are in the lead when it comes to DeFi?

Currently, the countries that have the most users of finance enabled by blockchain technology are Israel, Denmark, Switzerland, Malta, and the United States. The countries with the most users of DeFi are India, China, Vietnam, and Indonesia.

What is the general opinion on DeFi among those who work in traditional banks?

Some feel that because of the lack of regulation and accountability in decentralized banks, there is less theft and fraud as a result. Others disagree, citing the fact that financial transactions are already highly regulated, so it would be difficult for these issues to continue occurring in a DeFi system.

What are the next steps for DeFi?

As trends continue moving toward more transparency and decentralization in traditional banking, we can only expect to see the same thing in financial protocols. With the popularity of DeFi continuing to grow, it is likely that a lot of the changes banks are making will also transfer over into these types of systems. DeFi also provides those who do not want to use banks with an alternative form of financial service that they can use without being tracked or having their information stolen.

What problems need to be solved before Decentralized Finance can become mainstream?

The general public still has a lot of fear about cryptocurrencies and blockchain technology’s security issues. However, this is just the beginning of the blockchain revolution. While there are still some issues with security and trust, we can expect these to be addressed as these technologies become more mainstream.

Defi staking vs crypto loans: Which use cases do they most benefit?

The DeFi market has been dominated by crypto loans for some time, but there is no doubt that staking will become more and more popular over time. In the future, we can expect both to be used for various reasons by various people. The main reason why crypto loans have been so popular is that they are extremely easy to obtain. DeFi has allowed users to get their own digital funds without even leaving the house, making it a lot easier to have access to their funds in an instant without having to open a bank account or wait for days.

Crypto Maniac Defi: How to make money in DeFi?

The easiest way to make money in this sector is first by learning all the ins and outs of it. Creating a high-quality blog about this has been proven to be an excellent way of earning money online.

Through crypto loans, users will be able to put up a large amount of their loaned capital as collateral, meaning that if they were ever unable to pay back what they borrowed, the lender would have ownership over their original cryptocurrency. This means that people who borrow cryptocurrency from other users can either sell it as quickly as possible or use it for trading purposes.

defi crypto lending: What are the most profitable contracts in DeFi?

There are many factors that go into deciding which investments to make in the DeFi space. Some of these factors include the value of collateral, time when a contract was made, liquidity, and the amount of interest charged. The most profitable contracts in DeFi are those that offer a higher interest rate.

The first DeFi application

The first DeFi application was Bitcoin, an example of decentralized currency, and many DeFi platforms, such as MakerDAO, are built upon existing blockchain infrastructure. The decentralized nature of these currencies allows for trustless transactions while avoiding the pitfalls of centralized systems, where an entity called a central bank can manipulate their holdings or manipulate exchange rates.

There are also projects that aim to create entirely new tokenized assets within the same blockchain payment infrastructure that functions as a store of value (such as Bitcoin). Such tokens include stablecoins, which are a subset of these asset-backed tokens. Examples of stablecoins include Tether and Maker Dai.

Ethereum and Decentralized finance (DeFi)

Ethereum founder Vitalik Buterin, who is a DeFi enthusiast, has created a decentralized bank on top of the Ethereum public blockchain. Etherisc is a novel protocol that builds on top of smart contracts. It is both decentralized and autonomous, meaning it enables peer-to-peer banking and payment services without the need for a third party or intermediary. Etherisc is designed to be secure, seamless and transparent in its operations.

DeFi has developed over time from Bitcoin – the proof of concept (PoC) for decentralized blockchain currency. In the wake of the financial crisis in 2007-2008, it was believed by some that Bitcoin could function as a new form of currency that might be more stable than existing fiat currencies like US dollars.

The DeFi market has grown beyond cryptocurrencies into tokenized assets. These assets provide users with greater levels of liquidity and efficiency from trading securities, goods and other forms of value without the need for a centralized institution to manage them. The market has now moved beyond simple risk/reward applications to include digital derivative contracts, which are used for hedging purposes and for speculation. Lastly, DeFi is now expanding into complex financial services like lending, credit and personal finance management tools using smart contracts on blockchain technology.

Conclusion – Is DeFi the future of finance?

In general, DeFi resolves the issue with traditional banking that is quite often overlooked: centralization. When centralized systems make decisions about what to do with people’s money, this can be a problem. DeFi allows for peer-to-peer transactions and eliminates the need for a third party to provide escrow services. This leads to much more trust and security between parties since each person knows their coins are going straight into someone else’s custody.

Some people who become interested in DeFi decide to invest in crypto loans instead. These loans are usually repaid with interest within a set timeframe. The interest rates on these loans can be quite high, sometimes reaching up to 25%. However, it is important to remember that these loans can also be risky since you are relying on someone else to pay back what they owe. If the person who lent you the money defaults and doesn’t pay back what they owe, then you might never see your payment.

There are many different ways to make money with DeFi, but one way to earn a profit is by using smart contracts. Since smart contracts are decentralized and exist on the blockchain, they cannot be changed or tampered with in any way.

References:

- https://ethereum.org/en/defi/

- https://www.investopedia.com/decentralized-finance-defi-5113835

- https://coinmarketcap.com/de/view/defi/

No Comments found