What is Solana? (SOL) – Explanation, Pros and Cons, History, Buying guide, Team, Wallets, Price prediction

Last Updated September 8, 2021

Contents

What is Solana?

Solana is a blockchain that focuses on improving the scaling factor, as well as the speed and cost of transaction. A ledger that has been fully committed to sharding enables this. It also has built-in privacy features like zk-SNARKS cryptography to protect your data from snooping third parties. In addition, it will have a state-of-the-art evolution strategy and safety measures so that users of this platform can enjoy greater credibility when transacting with each other or with third party authorities on their own terms. Solana is projected to be able to handle up to 50.000 TPS (transactions per second) without losing decentralization or compromising its governance model.

- Solana is called a high-speed blockchain because it achieves block times of 400 ms and is capable of handling more than 50,000 transactions per second because it uses a proprietary timestamping system: proof of history (PoH)

- The core team behind Solana is high profile with former employees from Qualcomm, Apple, Dropbox, Intel, Microsoft, etc.

- Solana received large investments of over $25 million in 2019 from major investors including Multicoin Capital, Foundation Capital, Distributed Global, Blocktower Capital, NGC Capital, and Rockaway Ventures.

What is Solana? – Explanation, Pros and Cons, History, Buying guide, Team, Wallets, Price prediction

In essence, Solana is a blockchain that has been designed to scale to meet the demands of every day users and large corporations with greater ease. You can even incorporate your data into the Solana network and not be censored for doing so.

Price

What are the benefits of Solana?

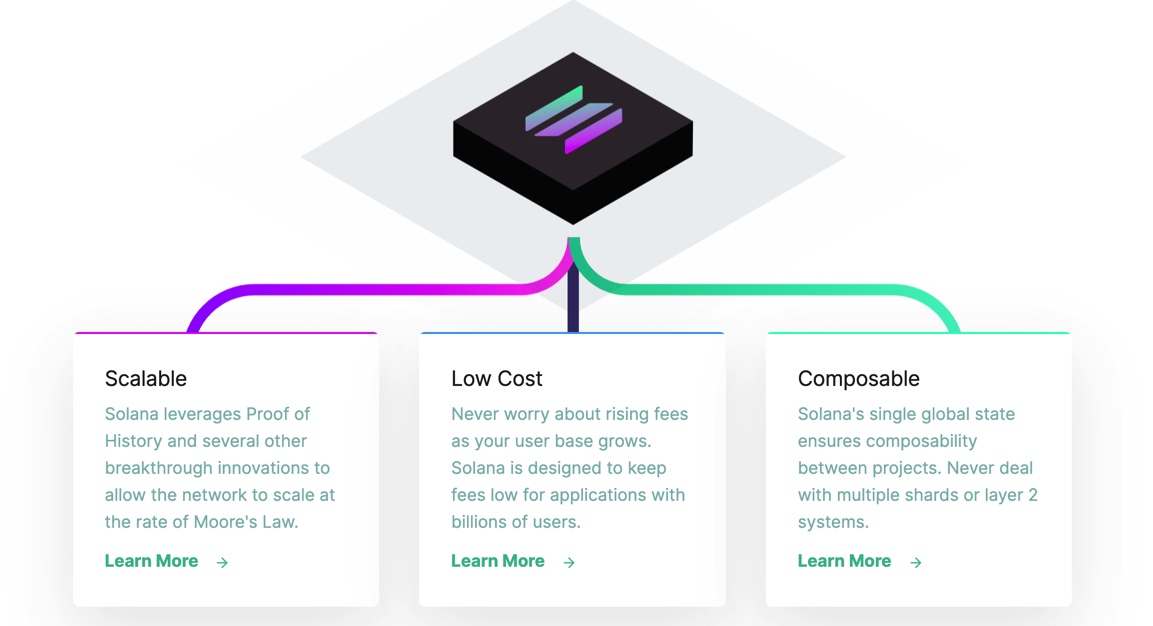

- Scalability – Solana leverages sharding technology to maintain its rate of transactions as well as its energy efficiency. This technology allows you to process all your transactions no matter how small or big they are, at an extremely fast pace while still leveraging decentralization for governance and security purposes.

- Security – Solana uses zero knowledge proofs to keep your data safe from third parties and keep your identity private.

- Decentralization – Solana will be able to meet all the demands of even the most demanding users of cryptocurrencies without compromising on its decentralization and governance model.

- Cost – Solana will be able to process transactions at a very fast speed while ensuring that you do not have to spend so much money in the process.

What is the business model of Solana?

Solana’s blockchain enables users to efficiently scale and transact on the blockchain. In return, they are rewarded with SOL tokens. They can also earn tokens by participating in governance or even offer faster nodes for other users. Some cases in which a node could be more powerful include account maintenance and resistant nodes which can also help in keeping the network decentralized. Solana will ensure that there is no single node that can go rogue and control the entire blockchain, making it thoroughly decentralized.

Solana’s business model, however, has been challenged by some users due to its lack of profitability at the moment and many claim that it will take a substantial amount of time before it can achieve this goal. They do not see any value in having a prediction or roadmap for the future until the team is able to provide something tangible.

Pros

Advantages of Solana

- very fast

- ETH interoperable

- Streams transactions without waiting for global consensus (without sacrificing security)

- low gas costs

- resistant to censorship

- delegated staking

- will even get faster, when hardware improves

- low barrieres of entry for validators

- supported by big players like FTX exchange and Alameda Research

- The performance of Solana is predicted to be very high since it has been designed to scale with the developments coming from the blockchain sector.

- It does not rely only on transaction fees according to its whitepaper, but also ecosystem development and value creation.

- It provides an additional layer of privacy through zero knowledge proofs which makes it very attractive for users who are concerned about their data being stolen by third parties.

- The scalability of Solana is guaranteed by its sharding technology which allows you to process all your transactions no matter how small or big they are at a fast pace while still leveraging decentralization for governance and security purposes.

- The application of the blockchain’s technology is not limited to the financial sector. It can be used for other industries such as insurance, legal and retail.

- It has a fair distribution method that gives everyone on the platform a chance to earn tokens from its ecosystem while protecting it from being exploited by centralized entities.

- Solana has been developed by experts in the field, making it built with security and scalability in mind. To help you maintain a high level of security, Solana will have a distributed network of nodes which are all chosen through blockchain voting. The average amount of tokens you will earn per day is through hosting nodes, contributing to governance or offering your node capacity for others.

- Solana has been created by a team of individuals in the blockchain industry, making it constructed with security and scalability in mind. To help you maintain a high level of security, Solana will have a distributed network of nodes which are all chosen through blockchain voting. The average amount of tokens you will earn per day is through hosting nodes, contributing to governance or offering your node capacity for others.

Cons

- Centralization still relatively high

- Still in Beta

- No clear roadmap yet

- Little Transparency

- A lot of users have not seen Solana as profitable at the moment due to its lack of working products. Affiliates and investors don’t see much value in the project until it can show them that there is something that they can earn from it.

- The business model of Solana has been challenged by some users due to its lack of profitability at the moment and many claim that it will take a substantial amount of time before it can achieve this goal. They do not see any value in having a prediction or roadmap for the future until the team is able to provide something tangible.

- It’s focus on scalability means that it is not going to process transactions as fast as other cryptocurrencies like Litecoin and Bitcoin, who are already providing efficient solutions in this regard.

- This project hasn’t gained much traction by users because of its low user base, which makes it very hard for the token price to increase at all.

- The fact that the Solana team is not transparent about certain aspects of their operations may be a bit disconcerting for potential investors and users, as they can not verify the credibility of the company.

How can I buy Solana?

Solana is available on several platforms including the following:

- Binance

- Gemini

- Coinbase

- Etoro

- Robinhood

- Exrates

- Huboi

- Bibox

- Kucoin

To buy Solana you first need to purchase BTC or ETH. After you have acquired your chosen cryptocurrency, you can either store it in a wallet or transfer it to Bittrex or Kucoin. From there, use the BTC or ETH that you just bought to purchase Solana and then store the tokens in your corresponding wallet.

Wallets

- Ledger Nano S

- Trezor

- Jaxx (Available for both BTC, ETH and fiat currencies)

- Ledger (Hardware wallet only, currently unsupported)

- Parity

- MyEtherWallet

Tokenholders can easily manage SOLANA tokens through popular web wallets: myetherwallet.com and etherscan.io or using the official desktop client on Windows or Mac OSX.

Trend

History of Solana

Solana was formed in 2017 and has been around for almost four years, having been started off as a fork of Ethereum. Much like its code base, Solana is looking to disrupt the cryptocurrency industry by providing a more secure and scalable solution than what is currently available.

Solana has been in production since June 2018 and its mainnet went into operation in Q3 2018. The team has varying backgrounds which include distributed systems, cryptography and network security, all of which are very relevant to the blockchain industry.

Solana has a very active developer community and regularly releases blogs on Medium and hosts live interviews with their development team on Youtube.

What is the difference between Solana vs Ethereum?

The main objective of Solana is to provide a scalable, secure and verifiable blockchain that supports high transaction-per-second performances while also providing incentives to those who want to stake tokens for rewards.

Conclusion

Solana aims to solve the scalability issues of blockchain for financial institutions and businesses by providing a network which is highly scalable. Until the project can provide good working products and a reliable roadmap, many users do not see the need for Solana. The low user base also doesn’t help either, making it hard to increase its value in the future with all of these factors being so much against it.

- a) Solana’s value is mainly found in its technical details and how it works. Technical details about blockchain networks have become mysteries that many in the blockchain community will try to figure out. Solana’s code is open source and anyone can check it for themselves.

- b) Solana has a working product as well as a roadmap, something which isn’t seen very often these days. Goals are there to help teams push forward with their project along with selling what needs to be sold. For example, Solana regularly provides updates on its development process, via Medium and Twitter for example.

- c) Solana has a strong development team and management team. All top roles are held by those who have been in the industry for many years or have been involved in multiple projects like this one. This is a plus for the project since its development and management teams are not beginners.

- d) Solana is traded all over so it’s easy to fund an account with any currency you want to use.

- e) Solana has a working product. This makes it trustworthy in the eyes of many investors.

No Comments found